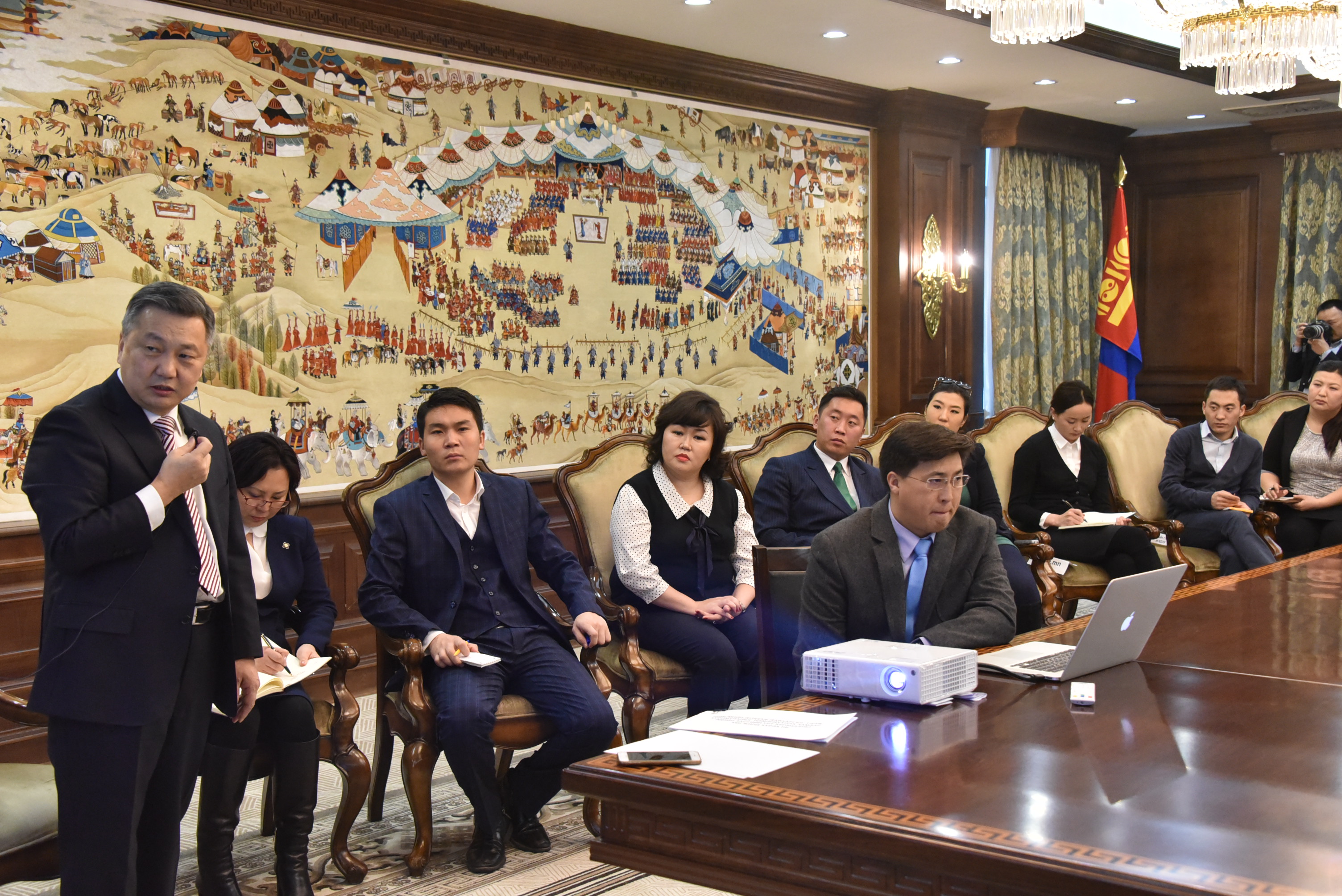

Speaker of Parliament Enkhbold Zandaakhuu spoke to the press about the program to establish long-term economic growth by expanding the middle class and increasing savings.

At the beginning of the introduction, he noted that lending had stopped throughout the country at the beginning of December due to Order 13 of the Constitutional Court, and said that he was going to provide an introduction of changes that were made to the mortgage market in the last three years and the results they have achieved. He noted that MPs are working to reinstate some clauses and regulations of the Civil Law and the Law on Real Estate Collateral which were invalidated by the Constitutional Court order. He also said that the government is preparing a draft that will transfer mortgages collected in the last three years to a pension fund. He added that this will not result in any negative outcome but will create an environment for stable future operations.

CEO of Mongolian Mortgage Corporation HFC LLC D.Gantugs introduced a report on the mortgage program which started on June 13, 2013.

The mortgage program was initiated in order to finance the rapidly growing mortgage market, develop a sustainable system for mortgage financing, and expand a program that was essential for society. Out of the 823,412 households of Mongolia, 537,682 live in urban areas. According to data compiled at the end of 2014, 148,600 households are living in apartments that are connected to the central heating and water supply out of a total of 352,812 households. A total of 204,000 families live in ger districts, and 189,240 of them have expressed that they would like to live in a comfortable apartment. Furthermore, according to a study conducted in the countryside, 15,456 families expressed interest in moving to Ulaanbaatar. It can be concluded from the above studies that there will be a demand for about 205,000 family apartments in Ulaanbaatar and province centers in the next five years. Out of a total 170,000 households that are planning to buy an apartment, 64,000 households are already saving for the down payment that’s needed to get an 8 percent interest rate mortgage, according to a statement made by the CEO of "Mongolian Mortgage Corporation HFC" LLC.

Mortgage lending started substantially increasing in 2010, and outstanding loans reached 2 trillion MNT at the end of 2013 and 3.4 trillion MNT at the end of 2015. The type of financial resource that is most commonly being used is the deposits of families and companies on top of bank savings. The fact that the number of borrowers has increased five-fold since 2010 is proof that it is a rapidly expanding market. In 2003, mortgages were issued with a five-year duration and 20 percent interest rate. In 2013, the government started the 8 percent interest rate mortgage program. According to a repayment report compiled by "MMC HFC" LLC, 0.01 percent of all outstanding loans are non-performing. In other words, out of a total of 47,500 families that have a mortgage, only 40 families had payments overdue. CEO of "Mongolian Mortgage Corporation HFC" LLC D.Gantugs emphasized that it can be observed that long-term low interest rate mortgages offer minimal risk. She continued and informed journalists about the advantages and financing of the 8 percent mortgage. (introduction in full)

Speaker of Parliament Enkhbold Zandaakhuu spoke about the importance of implementing the low interest mortgage program, which offers various positive outcomes to the people of Mongolia. He also emphasized that it was not easy to bring the legal environment for mortgages together.

"Properties that are saved at banks are identified as collateral according to the distinguished lawyer B.Chimid, and this was stated in the law. Many people were against this in 2009, when I was working as the head of the working group. But we decided this amendment needed to be stated in the law, and the law was passed in 2012. This law has been implemented up until now, But the Constitutional Court looked at collateral and the certificate of ownership as one and made its decision. Because of this, loans collateralizing owned assets such as apartments and cars have been suspended. So, Parliament decided that urgent action was needed. This is why we are saying that the 13th Order of the Constitutional Court is 100 percent wrong." The Speaker went on to explain the need to continue the 8 percent mortgage program, the results of the program, the outlook of the market, and why the program was suspended.

"The 13th Order in 2015 of the Constitutional Court made it possible for the borrower to sell, present, or re-pledge collateral without the permission of the lender. This may occur if the borrower, citizen, or an entity is given better opportunities, but it limits their chance to get a loan product or service. Because it meant higher risk for the loan and left collateral incapable of covering the borrower's debt, it created an environment where no loans could be obtained. Had it not been for the Constitutional Court's decision, at least 800 households, or an average of 1,300 households a month and about 9.6 to 15.6 thousand households a year, could have been newly accommodated with apartments.

"For instance, 200 households that were waiting for a decision to move into their apartments located in Buyant Ukhaa 2 Town could not get approval. Not only were the families who were expecting to move into their apartments feeling the toll of this decision, but also, the State Housing Finance Corporation could not get the financing that was expected to be released by the bank. Because of this, they could not fulfill the payment to the National Construction Corporation for their work. Furthermore, the National Construction Agency could not pay construction material suppliers, which led to them not being able to give salaries to their workers. It also led to the decline of furniture sales and became a reason for the suspension of small companies that do interior design and other micro businesses. A chain reaction was triggered by a single decision. We are working to put in place an environment to continue mortgage because of this sensitive situation."

Speaker of Parliament Z.Enkhbold explained the possibilities for increasing the accessibility of mortgages, and about the possibility of lowering the mortgage interest rate of 8 percent to 5 percent, and demonstrated possible variations on a mortgage calculator. The Speaker discussed the economic benefits that may occur for a family’s finances by cutting their interest rate.

Present for the Speaker’s introduction about the results of the mortgage program were Governor of Mongol Bank N.Zoljargal, Chairman of Mongolian Mortgage Corporation Holding JSC M.Munkhbaatar, CEO of Mongolian Mortgage Corporation D.Gantugs, and CEO of the Mongolian Banker’s Union J.Unenbat.

Speaker of Parliament Enkhbold Zandaakhuu spoke to the press about the program to establish long-term economic growth by expanding the middle class and increasing savings.

At the beginning of the introduction, he noted that lending had stopped throughout the country at the beginning of December due to Order 13 of the Constitutional Court, and said that he was going to provide an introduction of changes that were made to the mortgage market in the last three years and the results they have achieved. He noted that MPs are working to reinstate some clauses and regulations of the Civil Law and the Law on Real Estate Collateral which were invalidated by the Constitutional Court order. He also said that the government is preparing a draft that will transfer mortgages collected in the last three years to a pension fund. He added that this will not result in any negative outcome but will create an environment for stable future operations.

CEO of Mongolian Mortgage Corporation HFC LLC D.Gantugs introduced a report on the mortgage program which started on June 13, 2013.

The mortgage program was initiated in order to finance the rapidly growing mortgage market, develop a sustainable system for mortgage financing, and expand a program that was essential for society. Out of the 823,412 households of Mongolia, 537,682 live in urban areas. According to data compiled at the end of 2014, 148,600 households are living in apartments that are connected to the central heating and water supply out of a total of 352,812 households. A total of 204,000 families live in ger districts, and 189,240 of them have expressed that they would like to live in a comfortable apartment. Furthermore, according to a study conducted in the countryside, 15,456 families expressed interest in moving to Ulaanbaatar. It can be concluded from the above studies that there will be a demand for about 205,000 family apartments in Ulaanbaatar and province centers in the next five years. Out of a total 170,000 households that are planning to buy an apartment, 64,000 households are already saving for the down payment that’s needed to get an 8 percent interest rate mortgage, according to a statement made by the CEO of "Mongolian Mortgage Corporation HFC" LLC.

Mortgage lending started substantially increasing in 2010, and outstanding loans reached 2 trillion MNT at the end of 2013 and 3.4 trillion MNT at the end of 2015. The type of financial resource that is most commonly being used is the deposits of families and companies on top of bank savings. The fact that the number of borrowers has increased five-fold since 2010 is proof that it is a rapidly expanding market. In 2003, mortgages were issued with a five-year duration and 20 percent interest rate. In 2013, the government started the 8 percent interest rate mortgage program. According to a repayment report compiled by "MMC HFC" LLC, 0.01 percent of all outstanding loans are non-performing. In other words, out of a total of 47,500 families that have a mortgage, only 40 families had payments overdue. CEO of "Mongolian Mortgage Corporation HFC" LLC D.Gantugs emphasized that it can be observed that long-term low interest rate mortgages offer minimal risk. She continued and informed journalists about the advantages and financing of the 8 percent mortgage. (introduction in full)

Speaker of Parliament Enkhbold Zandaakhuu spoke about the importance of implementing the low interest mortgage program, which offers various positive outcomes to the people of Mongolia. He also emphasized that it was not easy to bring the legal environment for mortgages together.

"Properties that are saved at banks are identified as collateral according to the distinguished lawyer B.Chimid, and this was stated in the law. Many people were against this in 2009, when I was working as the head of the working group. But we decided this amendment needed to be stated in the law, and the law was passed in 2012. This law has been implemented up until now, But the Constitutional Court looked at collateral and the certificate of ownership as one and made its decision. Because of this, loans collateralizing owned assets such as apartments and cars have been suspended. So, Parliament decided that urgent action was needed. This is why we are saying that the 13th Order of the Constitutional Court is 100 percent wrong." The Speaker went on to explain the need to continue the 8 percent mortgage program, the results of the program, the outlook of the market, and why the program was suspended.

"The 13th Order in 2015 of the Constitutional Court made it possible for the borrower to sell, present, or re-pledge collateral without the permission of the lender. This may occur if the borrower, citizen, or an entity is given better opportunities, but it limits their chance to get a loan product or service. Because it meant higher risk for the loan and left collateral incapable of covering the borrower's debt, it created an environment where no loans could be obtained. Had it not been for the Constitutional Court's decision, at least 800 households, or an average of 1,300 households a month and about 9.6 to 15.6 thousand households a year, could have been newly accommodated with apartments.

"For instance, 200 households that were waiting for a decision to move into their apartments located in Buyant Ukhaa 2 Town could not get approval. Not only were the families who were expecting to move into their apartments feeling the toll of this decision, but also, the State Housing Finance Corporation could not get the financing that was expected to be released by the bank. Because of this, they could not fulfill the payment to the National Construction Corporation for their work. Furthermore, the National Construction Agency could not pay construction material suppliers, which led to them not being able to give salaries to their workers. It also led to the decline of furniture sales and became a reason for the suspension of small companies that do interior design and other micro businesses. A chain reaction was triggered by a single decision. We are working to put in place an environment to continue mortgage because of this sensitive situation."

Speaker of Parliament Z.Enkhbold explained the possibilities for increasing the accessibility of mortgages, and about the possibility of lowering the mortgage interest rate of 8 percent to 5 percent, and demonstrated possible variations on a mortgage calculator. The Speaker discussed the economic benefits that may occur for a family’s finances by cutting their interest rate.

Present for the Speaker’s introduction about the results of the mortgage program were Governor of Mongol Bank N.Zoljargal, Chairman of Mongolian Mortgage Corporation Holding JSC M.Munkhbaatar, CEO of Mongolian Mortgage Corporation D.Gantugs, and CEO of the Mongolian Banker’s Union J.Unenbat.