As of December 31, 2016

Since 2000, housing finance has been developed based on the private sector. While the financial supply of this sector has been funded by independent financial resources, down payments for orders and bank loans, financial demand was funded by public deposits, family support, and relatively high interest rate loans.

Providing the constantly increasing housing demand with resources that are only based on bank deposits was problematic, as it meant financing long-term financial needs with short-term finances. It resulted in problems such as short-term mortgages with high interest rates.

As banks actively grew in tandem with the country’s GDP growth, a rise in housing market demands made it even more necessary to develop a secondary mortgage market.

Housing finance systems are comprised of primary and secondary mortgage markets. The primary mortgage market has been developing in Mongolia since 2003, together with the introduction of mortgages to the Mongolian banking system.

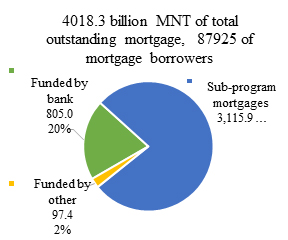

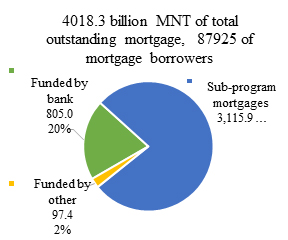

As of December, 2016 total outstanding mortgages had grown to 4,018.3 billion MNT, while mortgages issued under sub-program initiated by government was 3.115.9 billion MNT ( 77.5%), banks own funding mortgages at 805.0 billion MNT (20.0%), mortgages funded by other source is at 97.4 billion MNT (2.4%).

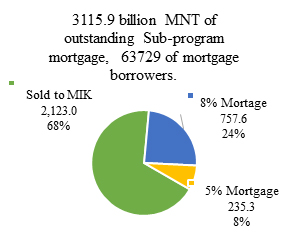

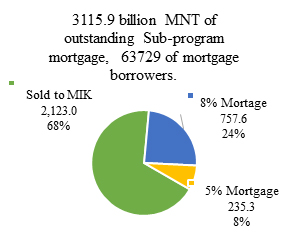

As of December, under sub-program 2,123.0 billion MNT (68%) of mortgages sold to MIK, 757.6 billion MNT (24%) is 8 percent mortgage loan, and 235.3 billion MNT (8%) is 5 percent mortgages.

Structure of the mortgage, billion, MNT /as of December, 2016/

|

|

The total number of mortgage borrowers had reached to 89.2 thousand, while borrowers who obtained mortgages constitutes 65.4 thousand of the total number of the borrowers. This illustrates that the total number of new borrowers had grown by 11.6 thousand of total 14.8 thousand from the last year.

|

Outstanding mortgage loan amount, billion, MNT |

2015.12 | 2016.11 | 2016.12 |

|

Total outstanding mortgages |

3,433.0 | 3,979.0 | 4,018.3 |

|

Funded by bank’s source |

777.1 | 798.5 | 805.0 |

|

Funded by other sources |

64.8 | 98.3 | 97.4 |

|

Sub-program mortgages |

2,591.0 | 3,082.9 | 3,115.9 |

|

Sold to MIK |

2,006.1 | 2,138.1 | 2,123.7 |

|

8% mortgages |

854.9 | 709.9 | 757.6 |

|

5% mortgages |

0.0 | 234.8 | 235.3 |

|

Total number of borrowers |

77,105 | 88,556 | 89,156 |

|

Total number of sub-program mortgage borrowers |

55,830 | 64,868 | 65,412 |

Source: Bank of Mongolia –Mortgage report

In terms of mortgage quality, overdue mortgages in total mortgage outstanding mortgage is at 2.5% which is 1.4% higher than the last year percentage of overdue mortgages of sub-program. Delinquent mortgage percentage in the total mortgage is at 2.3% which is notably higher than the sub-program delinquent mortgage percentage of 0.4%. From the last month percentage of overdue loan has fallen respectively and delinquent loan has growth, however, amounts had grown from the last year.

|

Quality of Mortgage loan |

2015.12 | 2016.11 | 2016.12 |

|

Overdue loan / Total mortgage loan |

1.9% | 3.1% | 2.5% |

|

Overdue loan /Sub-program loan |

0.6% | 1.3% | 1.4% |

|

Delinquent loan /Total mortgage loan |

1.8% | 2.6% | 2.3% |

|

Delinquent loan /Sub-program loan |

0.1% | 0.4% | 0.4% |

Source: Bank of Mongolia –Mortgage loan report

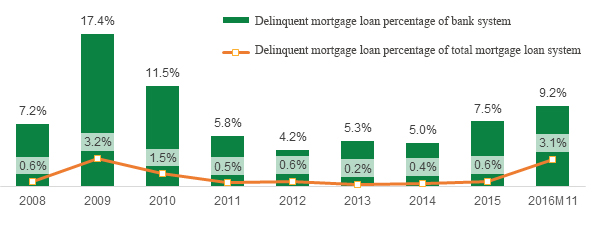

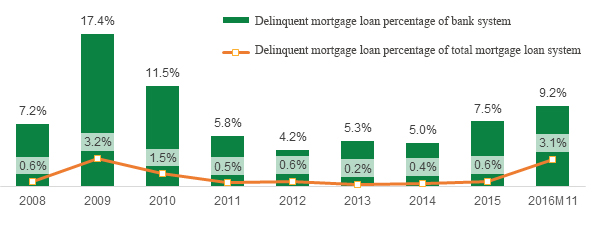

As of August, 2016 percentage of delinquent loan of bank’s system had reached 9.2% while the percentage of delinquent mortgage loan in the total mortgage market was 3.1%. Hence we can conclude that quality of mortgage loan is better than the other type of loans in the bank’s system.

As of December 31, 2016

Since 2000, housing finance has been developed based on the private sector. While the financial supply of this sector has been funded by independent financial resources, down payments for orders and bank loans, financial demand was funded by public deposits, family support, and relatively high interest rate loans.

Providing the constantly increasing housing demand with resources that are only based on bank deposits was problematic, as it meant financing long-term financial needs with short-term finances. It resulted in problems such as short-term mortgages with high interest rates.

As banks actively grew in tandem with the country’s GDP growth, a rise in housing market demands made it even more necessary to develop a secondary mortgage market.

Housing finance systems are comprised of primary and secondary mortgage markets. The primary mortgage market has been developing in Mongolia since 2003, together with the introduction of mortgages to the Mongolian banking system.

As of December, 2016 total outstanding mortgages had grown to 4,018.3 billion MNT, while mortgages issued under sub-program initiated by government was 3.115.9 billion MNT ( 77.5%), banks own funding mortgages at 805.0 billion MNT (20.0%), mortgages funded by other source is at 97.4 billion MNT (2.4%).

As of December, under sub-program 2,123.0 billion MNT (68%) of mortgages sold to MIK, 757.6 billion MNT (24%) is 8 percent mortgage loan, and 235.3 billion MNT (8%) is 5 percent mortgages.

Structure of the mortgage, billion, MNT /as of December, 2016/

|

|

The total number of mortgage borrowers had reached to 89.2 thousand, while borrowers who obtained mortgages constitutes 65.4 thousand of the total number of the borrowers. This illustrates that the total number of new borrowers had grown by 11.6 thousand of total 14.8 thousand from the last year.

|

Outstanding mortgage loan amount, billion, MNT |

2015.12 | 2016.11 | 2016.12 |

|

Total outstanding mortgages |

3,433.0 | 3,979.0 | 4,018.3 |

|

Funded by bank’s source |

777.1 | 798.5 | 805.0 |

|

Funded by other sources |

64.8 | 98.3 | 97.4 |

|

Sub-program mortgages |

2,591.0 | 3,082.9 | 3,115.9 |

|

Sold to MIK |

2,006.1 | 2,138.1 | 2,123.7 |

|

8% mortgages |

854.9 | 709.9 | 757.6 |

|

5% mortgages |

0.0 | 234.8 | 235.3 |

|

Total number of borrowers |

77,105 | 88,556 | 89,156 |

|

Total number of sub-program mortgage borrowers |

55,830 | 64,868 | 65,412 |

Source: Bank of Mongolia –Mortgage report

In terms of mortgage quality, overdue mortgages in total mortgage outstanding mortgage is at 2.5% which is 1.4% higher than the last year percentage of overdue mortgages of sub-program. Delinquent mortgage percentage in the total mortgage is at 2.3% which is notably higher than the sub-program delinquent mortgage percentage of 0.4%. From the last month percentage of overdue loan has fallen respectively and delinquent loan has growth, however, amounts had grown from the last year.

|

Quality of Mortgage loan |

2015.12 | 2016.11 | 2016.12 |

|

Overdue loan / Total mortgage loan |

1.9% | 3.1% | 2.5% |

|

Overdue loan /Sub-program loan |

0.6% | 1.3% | 1.4% |

|

Delinquent loan /Total mortgage loan |

1.8% | 2.6% | 2.3% |

|

Delinquent loan /Sub-program loan |

0.1% | 0.4% | 0.4% |

Source: Bank of Mongolia –Mortgage loan report

As of August, 2016 percentage of delinquent loan of bank’s system had reached 9.2% while the percentage of delinquent mortgage loan in the total mortgage market was 3.1%. Hence we can conclude that quality of mortgage loan is better than the other type of loans in the bank’s system.