The main business of "Mongolian Mortgage Corporation" HFC LLC is to purchase portfolios of mortgage loans from financial institutions and to facilitate the securitization of a portfolio to provide liquidity and risk mitigation to such financial institutions. Furthermore, "MIK HFC" LLC contributes to the development of the bond market by launching diverse products.

"MIK HFC" LLC has, through its own financial resources, made 19 purchases of mortgage pools from 9 commercial banks that amount to nearly 1.9 trillion MNT, and performs asset management and risk management. Meanwhile, the company has implemented several projects and programs in cooperation with a number of international financial organizations, including the United States Agency for International Development (USAID), the International Finance Corporation (IFC), German Bank for Reconstruction and Development (KfW), and Wharton Business School in the USA.

The main business of Mongolian Mortgage Corporation HFC LLC is to purchase portfolios of mortgage loans from financial institutions and to facilitate the securitization of a portfolio to provide liquidity and risk mitigation to such financial institutions. Furthermore, MIK HFC LLC contributes to the development of the bond market by launching diverse products.

MIK HFC LLC has, through its own financial resources, made 19 purchases of mortgage pools from 9 commercial banks that amount to nearly 1.9 trillion MNT, and performs asset management and risk management. Meanwhile, the company has implemented several projects and programs in cooperation with a number of international financial organizations, including the United States Agency for International Development (USAID), the International Finance Corporation (IFC), German Bank for Reconstruction and Development (KfW), and Wharton Business School in the USA.

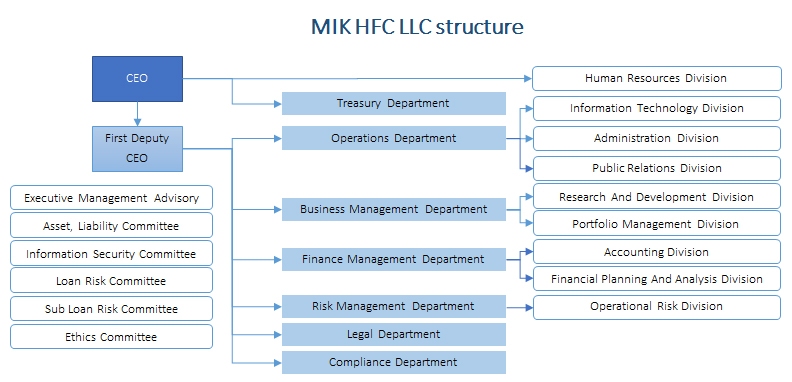

| Management team |

Title |

| B. Gantulga |

Chief Executive Officer |

|

Z. Munkh-Orgil |

First Deputy CEO |

| J. Onon |

Director of Business Management Department |

|

M. Bat-Ulzii |

Director of Finance Management Department |

| A. Anar |

Director of Operations Department |

| S. Amarsaikhan |

Director of Risk Management Department |

| G. Sansar |

Director of the Treasury Department |

|

B. Bolortuya |

Director of Legal Department |

| N. Enkhmaa |

Director of Compliance Department |

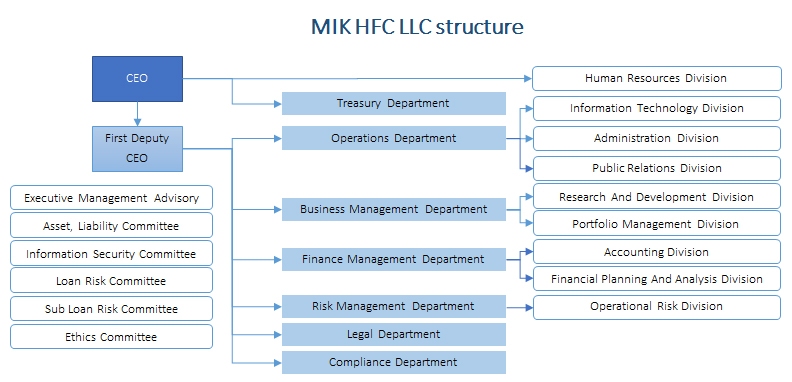

| Management team |

Title |

| B. Gantulga |

Chief Executive Officer |

|

Z. Munkh-Orgil |

First Deputy CEO |

| J. Onon |

Director of Business Management Department |

|

M. Bat-Ulzii |

Director of Finance Management Department |

| A. Anar |

Director of Operations Department |

| S. Amarsaikhan |

Director of Risk Management Department |

| G. Sansar |

Director of the Treasury Department |

|

B. Bolortuya |

Director of Legal Department |

| N. Enkhmaa |

Director of Compliance Department |