A light that may show Mongolia’s economy kneeled in crisis the way to recovery has been lit with a very important sale opened at the MSE. "Mongolian Mortgage Corporation Holding" LLC, the parent company of "Mongolian Mortgage Corporation HFC" LLC, changing its structure and becoming a publicly traded company marks a new beginning in the history of Mongolia’s capital market.

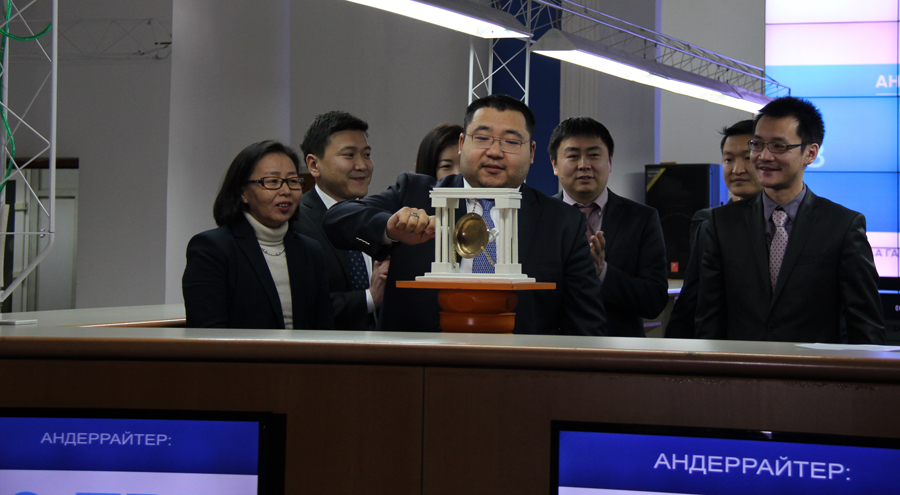

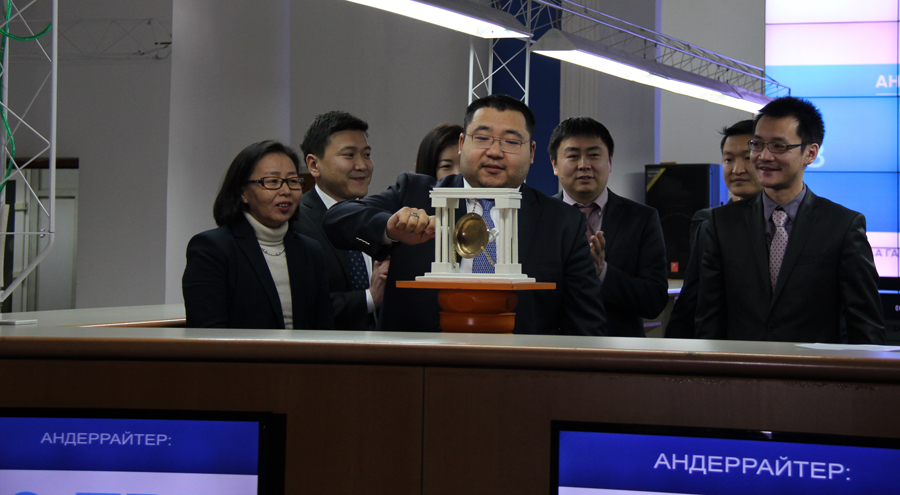

This day when Mongolian Mortgage Corporation launched an IPO and started trading its shares on the capital market is a day worth remembering, as it contributed to the great work of providing citizens with housing. Primary market sales of the common stocks for Mongolian Mortgage Corporation Holding began with the of the company’s Chairman M.Munkhbaatar.

Mongol Bank established the Mongolian Mortgage Corporation 10 years ago, together with 10 domestic banks. As a result of the mortgage program which began in mid 2013, the company grew to be valued at 1.9 trillion MNT and has a business valuation of 213.7 billion MNT.

What should we expect from this operation and the understanding of terms that have not yet become familiar to Mongolians? Mongolian Mortgage Corporation is special because it is the only company that has the right to issue ABS in Mongolia. This is a company that is aimed at supporting the work to provide Mongolians with adequate housing. Mongolian Mortgage Corporation buys loans issued by banks to citizens, securitizes them, and aims to support the development of primary and secondary markets for mortgages, provide the financial market with liquidity and lower risks. A short and comprehensive definition would be that MIK is not a bank that issues mortgages to people, but it carries out financial engineering between borrowers and banks.

The company has bought and securitized 1.9 trillion MNT in mortgages from banks with the implementation of the program to create a sustainable system of mortgage financing.

The Chairman of "Mongolian Mortgage Corporation Holding" LLC informed journalists that they are planning to raise 37.3 billion MNT through an IPO and a ceremony for the opening of public market trading. Mongolian Mortgage Corporation Holding is offering 3,106,398 shares that are equal to 15 percent of the company, and plans to buy back mortgage portfolios with the money it raises.

According to its prospectus, the company stated that it has budgeted the portfolios it will buy based on its plan to establish four SPCs in 2016, three each year between 2017-2019, and issue 200 billion MNT in bonds through each SPC. In other words, they plan to establish 13 SPCs in the next four years and issue 2.6 trillion MNT in mortgage backed securities.

According to the financial plan of "Mongolian Mortgage Corporation Holding" LLC and its subsidiaries, it is expected that the EPS offered to investors will reach 4,885 MNT at the end of the next four years. Judging from this, the underwriting company TDB Capital and security issuer "Mongolian Mortgage Corporation Holding" LLC emphasized that the yield offered to investors is very high.

As of now, 80.9 percent of MMC Holding’s outstanding shares are held by commercial banks, 14.8 percent by DBM, 2.3 percent by Mongol Bank, and the remaining 1.7 percent by entities.

Now we’ll tell you what the nominal price of the share is. At first, we offered the investors who held our stocks as of December 4, 2015, the senior shares proportionately. Forty-three percent of all the shareholders used their exclusive rights and bought the shares before the IPO. Then, the company sold shares that were not obtained with senior rights to the public. The senior shares were priced at 12,000 MNT, as was the price offered to the public through the IPO.

Everybody wondered if it was effective to launch an IPO when the 8 percent mortgage had stopped.

Let me explain a few facts.

First: There are 17,000 apartments for sale on the market waiting for buyers. In Ulaanbaatar alone there are 477 projects already in implementation for 101,000 familes.

Second: There are 823,000 households living in ger districts nationwide, 352,800 of which live in Ulaanbaatar. Fifty percent of the 204,600 families that wish to buy an apartment have started collecting their documents and saving the down payment. These are people who have already made this simple calculation needed to get a mortgage. They can also be referred to as future borrowers. It can be concluded from this that the 8 percent mortgage is needed on both the demand and supply side. It is only fair that Mongolian Mortgage Corporation values its product as high-demand.

Third: Judging from the 8 percent mortgage that has been issued in the last few years, a household gets an average loan of 49 million MNT for 16.6 years. Because the repayment of this loan is considered “excellent”, the 8 percent loan is exactly what’s needed in the market.

Fourth: More proof is in Mongolian Mortgage Corporation’s report. In the last three years, MMC managed to multiply it’s capital 9.3 times and its total capital 101.4 times. This is a huge success earned in a short period of time. By 2014, the company’s capital yield reached 26 percent, and we plan to substantially increase it in the next five years. In our business plan, we expect capital yield to be constant at 24 percent starting in 2019.

But the only thing that can be a true indicator of these developments and control their direction is the Mongolian people. The housing program and everything that happens around the 8 percent mortgage program will always be at the center of attention.

Finally, the IPO of "Mongolian Mortgage Corporation" LLC makes it possible for the public to control, contribute, take responsibility for, and get yields from the operation through their investment in the country, a change from when only the founders of a company saw the benefits of the company’s operations.

Becoming a publicly traded company on the Mongolian Stock Exchange makes it possible for the company to raise capital from international and domestic markets. And by offering 3,106,398 common shares on the market on December 24, 2015, through its IPO, the company raised 37,276,776,000 MNT from the capital market. The MSE named Mongolian Mortgage Corporation the only company that fulfills requirements for a 1st level company.

A light that may show Mongolia’s economy kneeled in crisis the way to recovery has been lit with a very important sale opened at the MSE. "Mongolian Mortgage Corporation Holding" LLC, the parent company of "Mongolian Mortgage Corporation HFC" LLC, changing its structure and becoming a publicly traded company marks a new beginning in the history of Mongolia’s capital market.

This day when Mongolian Mortgage Corporation launched an IPO and started trading its shares on the capital market is a day worth remembering, as it contributed to the great work of providing citizens with housing. Primary market sales of the common stocks for Mongolian Mortgage Corporation Holding began with the of the company’s Chairman M.Munkhbaatar.

Mongol Bank established the Mongolian Mortgage Corporation 10 years ago, together with 10 domestic banks. As a result of the mortgage program which began in mid 2013, the company grew to be valued at 1.9 trillion MNT and has a business valuation of 213.7 billion MNT.

What should we expect from this operation and the understanding of terms that have not yet become familiar to Mongolians? Mongolian Mortgage Corporation is special because it is the only company that has the right to issue ABS in Mongolia. This is a company that is aimed at supporting the work to provide Mongolians with adequate housing. Mongolian Mortgage Corporation buys loans issued by banks to citizens, securitizes them, and aims to support the development of primary and secondary markets for mortgages, provide the financial market with liquidity and lower risks. A short and comprehensive definition would be that MIK is not a bank that issues mortgages to people, but it carries out financial engineering between borrowers and banks.

The company has bought and securitized 1.9 trillion MNT in mortgages from banks with the implementation of the program to create a sustainable system of mortgage financing.

The Chairman of "Mongolian Mortgage Corporation Holding" LLC informed journalists that they are planning to raise 37.3 billion MNT through an IPO and a ceremony for the opening of public market trading. Mongolian Mortgage Corporation Holding is offering 3,106,398 shares that are equal to 15 percent of the company, and plans to buy back mortgage portfolios with the money it raises.

According to its prospectus, the company stated that it has budgeted the portfolios it will buy based on its plan to establish four SPCs in 2016, three each year between 2017-2019, and issue 200 billion MNT in bonds through each SPC. In other words, they plan to establish 13 SPCs in the next four years and issue 2.6 trillion MNT in mortgage backed securities.

According to the financial plan of "Mongolian Mortgage Corporation Holding" LLC and its subsidiaries, it is expected that the EPS offered to investors will reach 4,885 MNT at the end of the next four years. Judging from this, the underwriting company TDB Capital and security issuer "Mongolian Mortgage Corporation Holding" LLC emphasized that the yield offered to investors is very high.

As of now, 80.9 percent of MMC Holding’s outstanding shares are held by commercial banks, 14.8 percent by DBM, 2.3 percent by Mongol Bank, and the remaining 1.7 percent by entities.

Now we’ll tell you what the nominal price of the share is. At first, we offered the investors who held our stocks as of December 4, 2015, the senior shares proportionately. Forty-three percent of all the shareholders used their exclusive rights and bought the shares before the IPO. Then, the company sold shares that were not obtained with senior rights to the public. The senior shares were priced at 12,000 MNT, as was the price offered to the public through the IPO.

Everybody wondered if it was effective to launch an IPO when the 8 percent mortgage had stopped.

Let me explain a few facts.

First: There are 17,000 apartments for sale on the market waiting for buyers. In Ulaanbaatar alone there are 477 projects already in implementation for 101,000 familes.

Second: There are 823,000 households living in ger districts nationwide, 352,800 of which live in Ulaanbaatar. Fifty percent of the 204,600 families that wish to buy an apartment have started collecting their documents and saving the down payment. These are people who have already made this simple calculation needed to get a mortgage. They can also be referred to as future borrowers. It can be concluded from this that the 8 percent mortgage is needed on both the demand and supply side. It is only fair that Mongolian Mortgage Corporation values its product as high-demand.

Third: Judging from the 8 percent mortgage that has been issued in the last few years, a household gets an average loan of 49 million MNT for 16.6 years. Because the repayment of this loan is considered “excellent”, the 8 percent loan is exactly what’s needed in the market.

Fourth: More proof is in Mongolian Mortgage Corporation’s report. In the last three years, MMC managed to multiply it’s capital 9.3 times and its total capital 101.4 times. This is a huge success earned in a short period of time. By 2014, the company’s capital yield reached 26 percent, and we plan to substantially increase it in the next five years. In our business plan, we expect capital yield to be constant at 24 percent starting in 2019.

But the only thing that can be a true indicator of these developments and control their direction is the Mongolian people. The housing program and everything that happens around the 8 percent mortgage program will always be at the center of attention.

Finally, the IPO of "Mongolian Mortgage Corporation" LLC makes it possible for the public to control, contribute, take responsibility for, and get yields from the operation through their investment in the country, a change from when only the founders of a company saw the benefits of the company’s operations.

Becoming a publicly traded company on the Mongolian Stock Exchange makes it possible for the company to raise capital from international and domestic markets. And by offering 3,106,398 common shares on the market on December 24, 2015, through its IPO, the company raised 37,276,776,000 MNT from the capital market. The MSE named Mongolian Mortgage Corporation the only company that fulfills requirements for a 1st level company.